As we look ahead to 2025, we are bullish about the progress we are making in our portfolio of communities. Watermark has seen strong growth in occupancy as more and more of our communities are achieving stabilized occupancy and our developments are rapidly filling up. With so much of the expense pressures now absorbed, community NOI and margins are recovering and/or exceeding expectations. We are seeing downward trends in agency, overtime, open positions, and associate turnover, which translates to an improved product and bottom-line results. While the days of 8-10% rent growth are likely gone, we still see the opportunity to recover margin through more moderate rate growth, pushing the envelope on membership fees, and continuing to manage expenses.

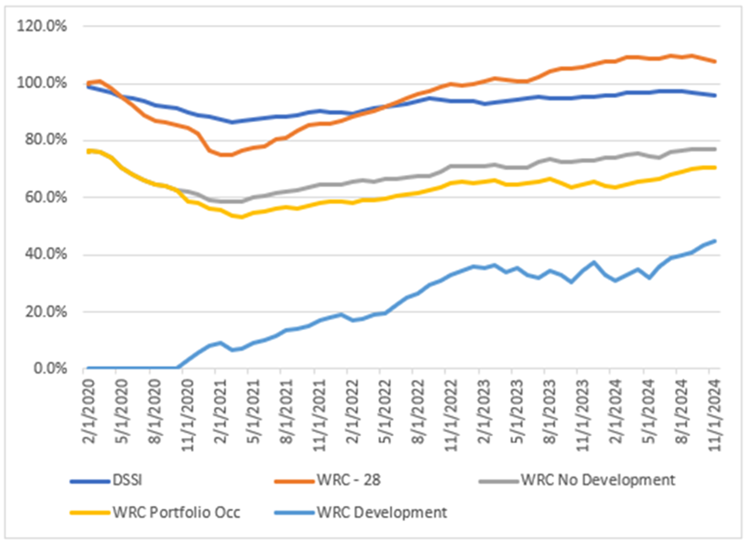

The chart below shows the recovery that Watermark has made since the onset of the pandemic. Our portfolio faced significant challenges early on due to its high concentration in New York and California, where heavy restrictions were in place. However, we have since recovered and outpaced the industry when comparing performance within our same-store portfolio. The lease-up of our developments has been extremely healthy and bodes well for 2025 and beyond with these projects well positioned for baby boomers.

On the new business side, we are well positioned with a strong development pipeline and anticipate several projects getting underway in 2025. These projects will continue to align with our strategy of higher-end and larger-scale IL, AL, and MC projects in either primary or secondary markets (concentrated on the “smile states” where we already have a strong presence). We have found these projects to be capable of overcoming the expense pressures that have plagued the industry in recent years and are more attractive to the baby boomers that are now beginning to hit our target market. The future is bright for the industry, and Watermark is prepared to capitalize on the surging fundamentals.