2023 was a banner year for the Watermark portfolio. We welcomed a total of 10 new projects to the Watermark family (seven developments located in Southern Florida, North Austin, Northern and Southern California and Portland along with three management transitions located in Northern California and the Pacific Northwest). And we currently have five more projects under construction that will open in 2024 which are located in the Florida panhandle as well as Southern Florida, Northern and Southern California, and the Pacific Northwest. Each of these projects fits well with our strategy around higher-end IL, AL, and MC communities that are located in strong demographic markets.

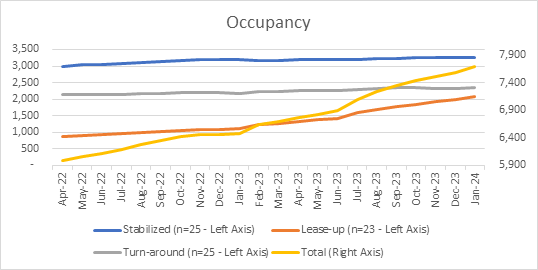

During 2023, the Watermark portfolio experienced an astounding 18% growth in occupancy (far outpacing the industry) which was led by our development lease-ups which increased by more than 84% during that time. Watermark’s same store portfolio included 60 communities in 2022 and 2023, and average occupancy from 2022 to 2023 grew by 10% with NOI improving by nearly 150%! Of the same store communities, nearly 85% experienced an increase in NOI greater than 5%.

Portfolio Occupied Beds by Property Type, April 2022 – January 2024

2024 is off to a similarly strong start with January shaping up to be a nearly 1.5% increase in occupancy from December. With the continued lease-ups of our developments, as well as ongoing refinement of rates and expenses in our turnaround and stabilized portfolio, the team is extremely optimistic about how 2024 NOI and margin will shape up. As well, we are continuing to expand our stabilized portfolio which now includes more than a third of our communities and boasts average occupancy greater than 90%. Cheers to the entire Watermark team and our partners for all of the work that has gone into making 2023 such a success with an eye to even greater improvement in 2024 and beyond.